Condo Insurance in and around Marble Falls

Townhome owners of Marble Falls, State Farm has you covered.

Insure your condo with State Farm today

Your Possessions Need Protection—and So Does Your Townhome.

When it's time to chill out, the home that comes to mind for you and your loved onesis your condo.

Townhome owners of Marble Falls, State Farm has you covered.

Insure your condo with State Farm today

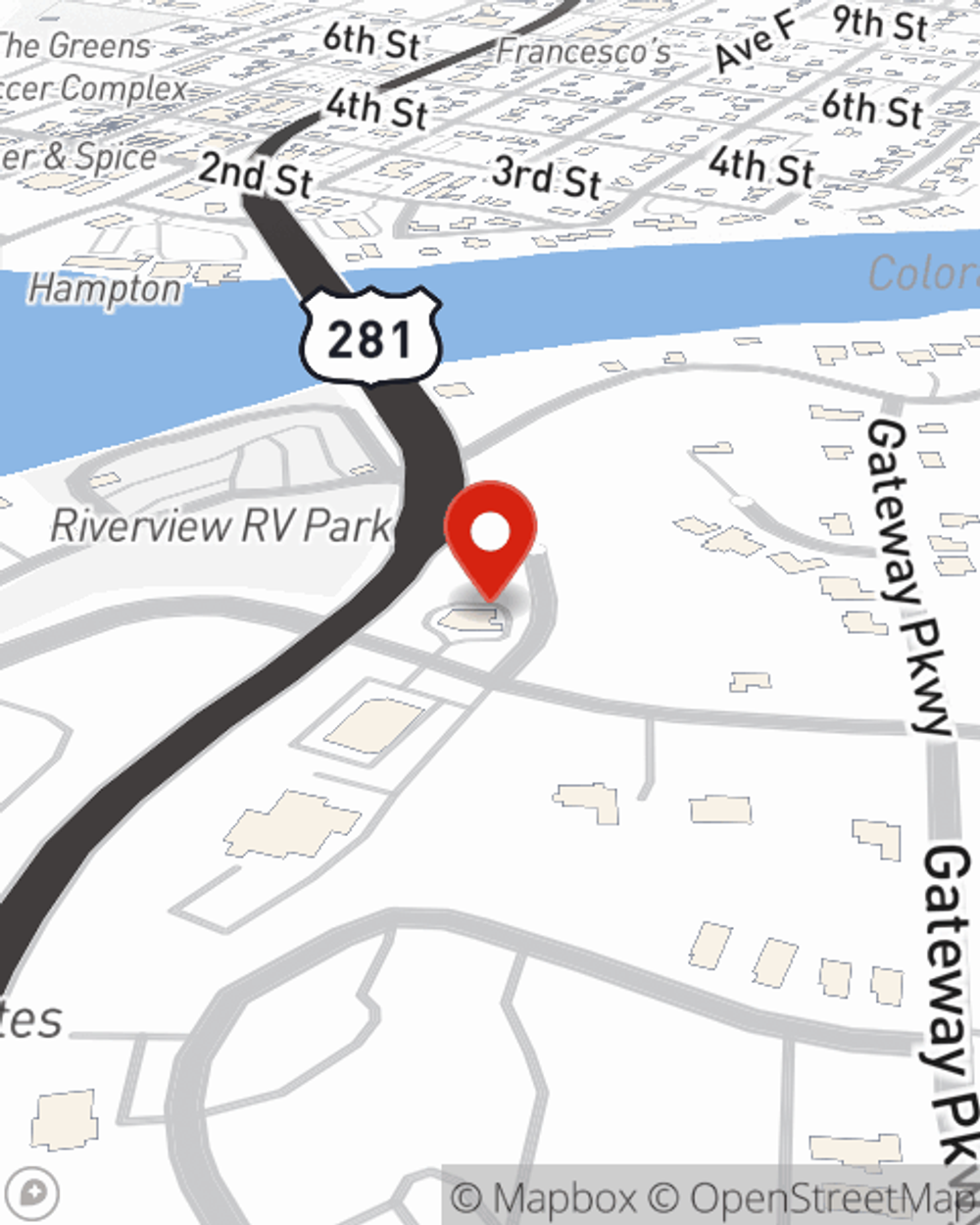

Agent Shane Stewart, At Your Service

We understand. That's why State Farm offers excellent Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Shane Stewart is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that works for you.

When your Marble Falls, TX, condo is insured by State Farm, even if the worst comes to pass, State Farm can help guard your one of your most valuable assets! Call or go online today and discover how State Farm agent Shane Stewart can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Shane at (830) 693-5693 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Shane Stewart

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.